Flexi provides a secure enterprise accounting platform that automates the entire accounting workflow process and delivers ROI in just months.

With Flexi, you will be afforded a flexible solution–one that won’t keep you stuck and unable to adapt to changing market or business needs.

Here are the top six important features you need to know about regarding Flexi’s enterprise accounting software.

- Continuous Close Capability: Flexi gives you the ability to conduct preliminary ‘soft close’ periods at any time, while the system continues to account for financial transactions in the meantime. You’ll have plenty of time to review and adjust financials in preparation for your hard close deadlines, with complete confidence in the accuracy of your reports.

- Automated, Workflow Driven Processes: Flexi’s powerful workflow engine mirrors your accounting processes electronically. Based on your business rules, tasks can be automated – saving time and removing the risk of costly mistakes. You remain in control with a complete archive – all available 24/7 from anywhere, through any device.

- Multi-Entity Accounting: Consolidating multiple general ledgers, company/franchise financial statements, and/or multiple currencies can easily consume days or weeks of time. Flexi simplifies even the most complex accounting environments and easily converts all of this disparate data into standardized, board-ready reports almost instantaneously. Learn more about our multi–entity accounting capabilities.

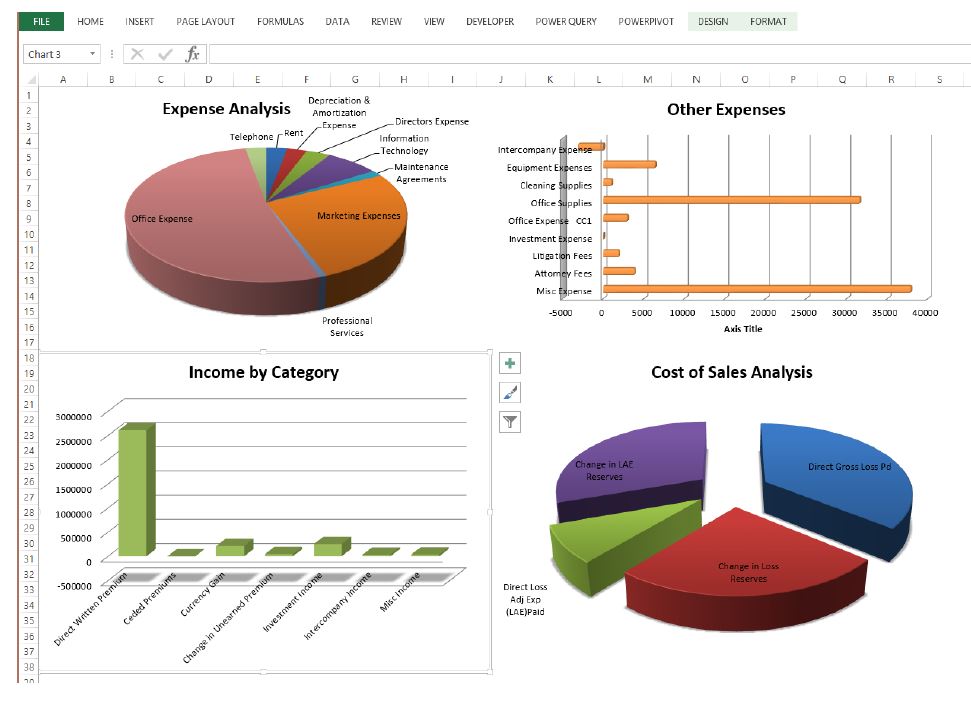

- Real-Time Visibility: View, analyze and report real-time financial data, ensuring business decisions are always based on accurate, timely data. With Flexi, you’ll have everything you need at your fingertips to visualize your financial position and make real-time business decisions.

- Complete Audit Trail and Compliance Documentation: Flexi provides immediate access to all details behind a transaction. Because each accounting module is part of the same system (including our general ledger), you can easily drill down into all transactions and trace all the way back to the original journal entries, including a visual map of the workflow and approvals.

- Streamlined Reporting with our Cloud Financial Report Writer: Flexi’s proprietary cloud financial reporting software will make you look good every time. Easily generate perfectly formatted reports and distribute the right data to the right people even for complex multi-national companies. Reports can be shared in Excel or web-based format and accessed anytime, through any device.

Learn more about Flexi today

From deployment options, implementation and setup of business rules, to integrations with other systems, Flexi’s got you covered.

Learn more or schedule a demo today. Call 800-353-9492.